Grab has you covered when you travel

When you go away on a trip, so should your worries. One of the concerns that you can cross off your list is insurance. This is where Grab has got you well-covered!

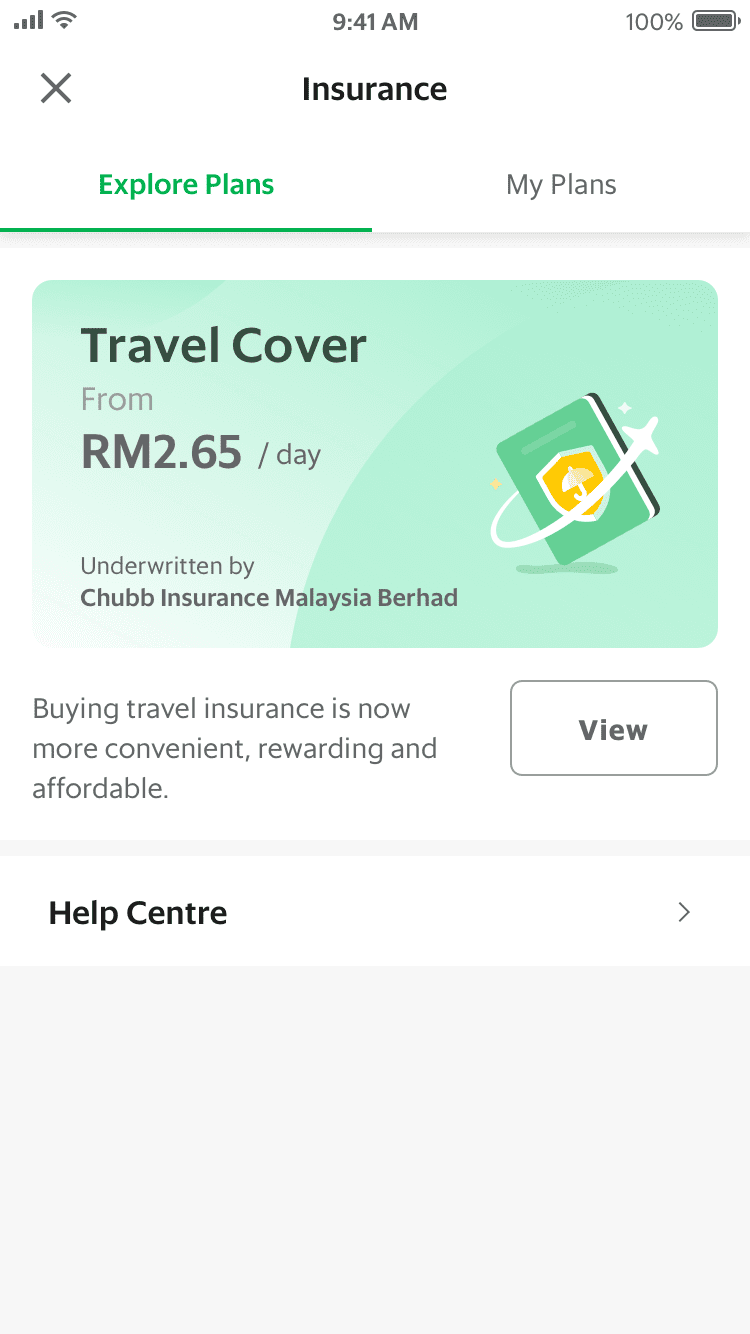

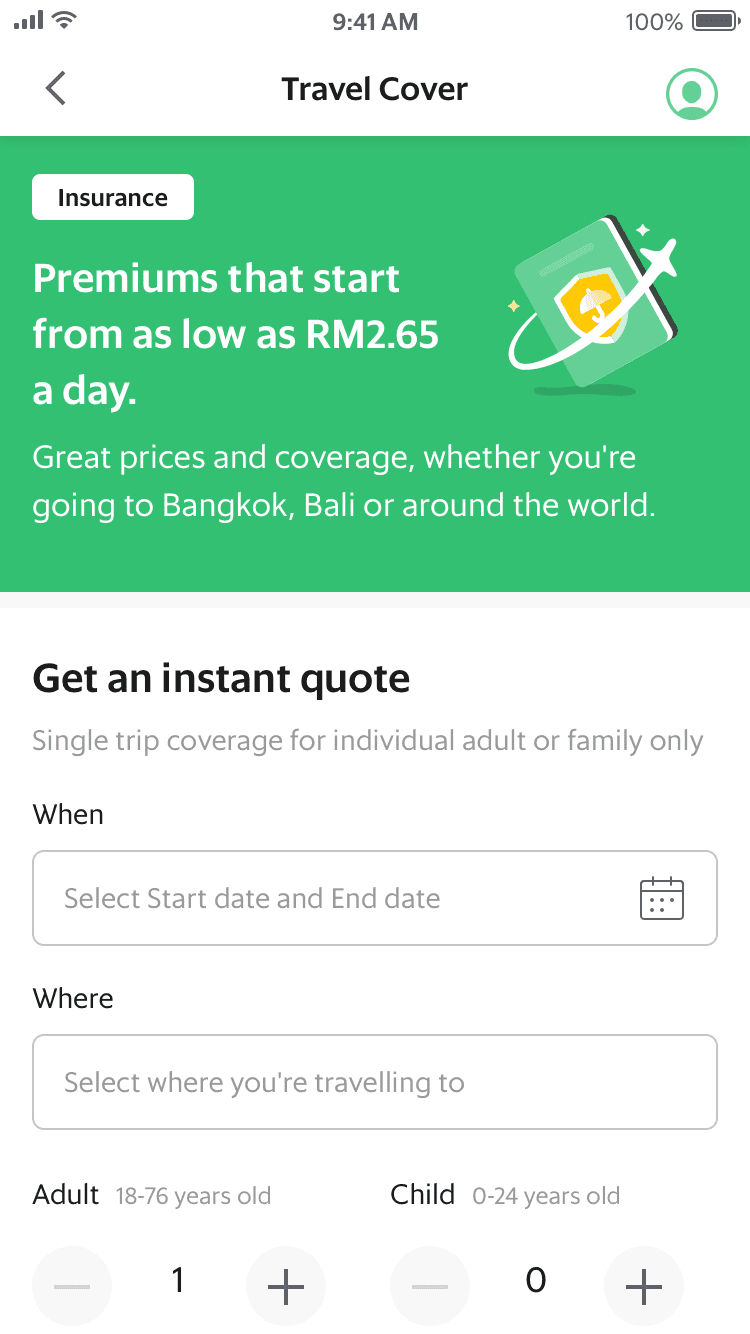

Grab has partnered with Chubb to create Travel Cover, an innovative and fuss-free solution to buying travel insurance for your next vacation, holiday, or business trip.

Be sure to get your Travel Cover before 14 March to enjoy 25% cashback.

Why get Travel Cover?

Convenient

Store your own and your travel companions’ profiles for future purchases.

Affordable

Premiums start as low as RM2.50 per day. Plus, you get 25% cashback in your GrabPay Wallet when you purchase before 14 March!

Seamless

Purchase directly from your everyday, everything app – the Grab App.

Comprehensive coverage

Enjoy coverage that includes personal accident protection, overseas medical expenses, and baggage and travel delays.

| Benefit | Coverage | Max Sum Insured (International) |

Max Sum Insured (Domestic) |

|---|---|---|---|

| 1. | Accidental Death & Disablement - Adult - Child |

RM200,000 RM20,000 |

RM100,000 RM10,000 |

| 2. |

Overseas Medical Expenses Due to Sickness - Up to age 65 years - Above age 65 years and up to age 75 years - Child |

RM300,000 RM300,000 RM60,000 RM300,000 RM300,000 RM60,000 |

RM20,000 RM20,000 RM20,000 N/A N/A N/A |

| 3. | Compassionate Visit |

RM10,000 | RM1,000 |

| 4. | Child Guard |

RM10,000 | RM1,000 |

| 5. | Emergency Medical Evacuation & Repatriation | Unlimited | RM100,000 |

| 6. | Repatriation of Mortal Remains (Includes Burial & Cremation) |

Unlimited | RM100,000 |

| 7. | Travel Cancellation | RM5,000 | RM1,500 |

| 8. | Travel Curtailment | RM5,000 | RM1,500 |

| 9. |

Loss or Damage of Personal Property and Baggage - Any one article limit - Portable Computer - Maximum Limit |

RM500 RM1,000 RM5,000 |

RM500 N/A RM1,000 |

| 10. |

Loss or Damage to Travel Documents |

RM5,000 | N/A |

| 11. |

Loss of Personal Money |

RM750 | N/A |

| 12. |

Fraudulent Use of Lost Credit Card |

RM500 | N/A |

| 13. |

Baggage Delay (Every Consecutive 6 Hours) Overseas - Amount per 6 hours - Per Family Limit In Malaysia - Amount Per 6 hours- Per Family Limit |

RM900 RM150 N/A N/A |

N/A RM600 RM150 |

| 14. | Travel Delay (Every 6 Consecutive Hours) - Max Limit |

RM150 RM2,400 |

RM150 RM600 |

| 15. | Personal Liability | RM1,000,000 | RM250,000 |

| 16. |

Home Inconvenience Allowance - Any one article limit |

RM3,000 RM500 |

N/A N/A |

| 17. |

24 hours Worldwide Chubb Assistance - 24-hour Telephone Access - Medical Assistance- Travel Assistance |

Included |

Included |

Affordably priced for both domestic and international travel!

Note: Premium is excluding 6% Sales and Service Tax (SST).

| Domestic Travel | Daily Premium Per Individual | Daily Premium Per Couple | Daily Premium Per Family |

||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Domestic | RM2.50 | RM4.90 | RM6.30 |

| International Travel | Daily Premium Per Individual | Daily Premium Per Couple | Daily Premium Per Family |

|---|---|---|---|

| Zone 1 | RM5.50 | RM10.70 | RM13.80 |

| Zone 2 | RM9.00 | RM17.60 | RM22.50 |

| Zone 3 | RM11.50 | RM22.40 | RM28.80 |

| Area of Coverage | |

|---|---|

| Zone 1 | Australia, Bangladesh, Brunei, Cambodia, China (excluding Tibet and Mongolia), Hong Kong SAR, India, Indonesia, Japan, Korea, Laos, Macau SAR, Maldives, Myanmar, New Zealand, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam. |

| Zone 2 | Worldwide including Zone 1 (Excluding US, Canada, Middle East, Nepal, Tibet, Mongolia & Cuba) |

| Zone 3 | Worldwide (Excluding Cuba) |

| Domestic | Within Malaysia and travelling more than 50km from place of residence |

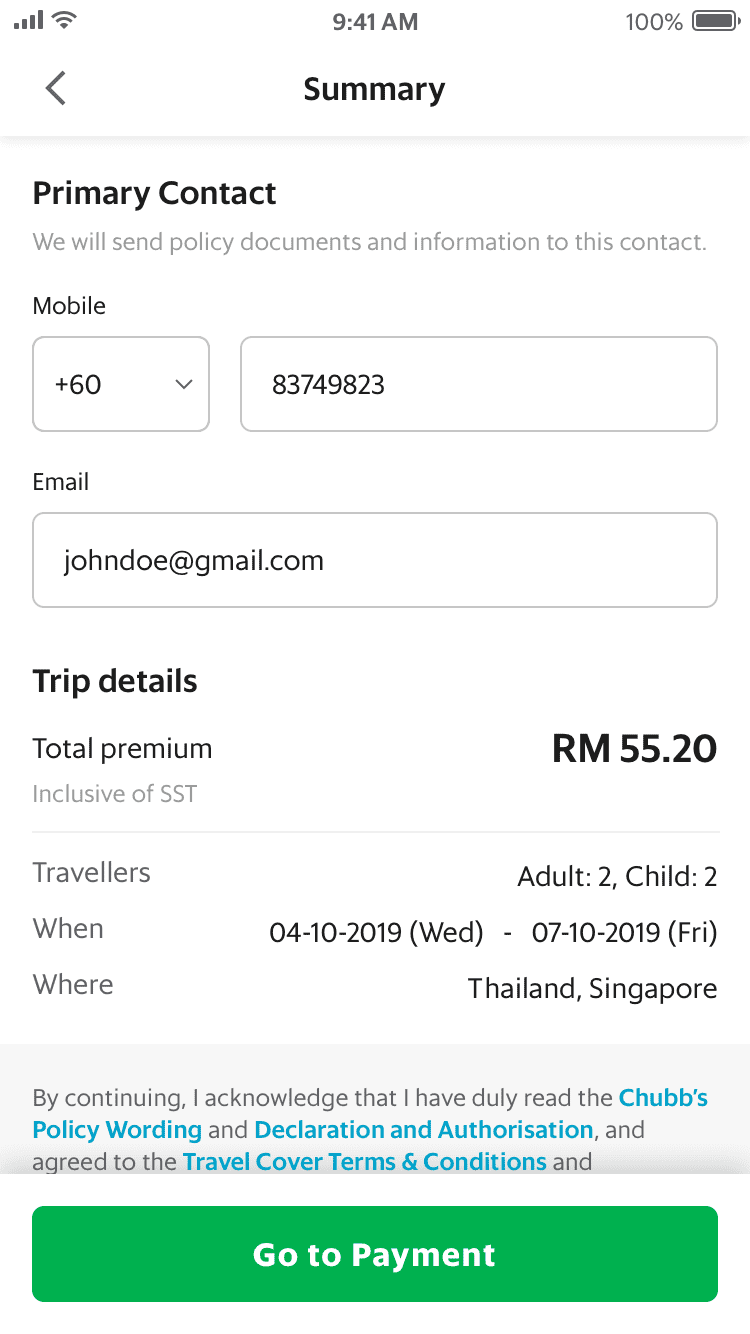

How to activate Travel Cover

-

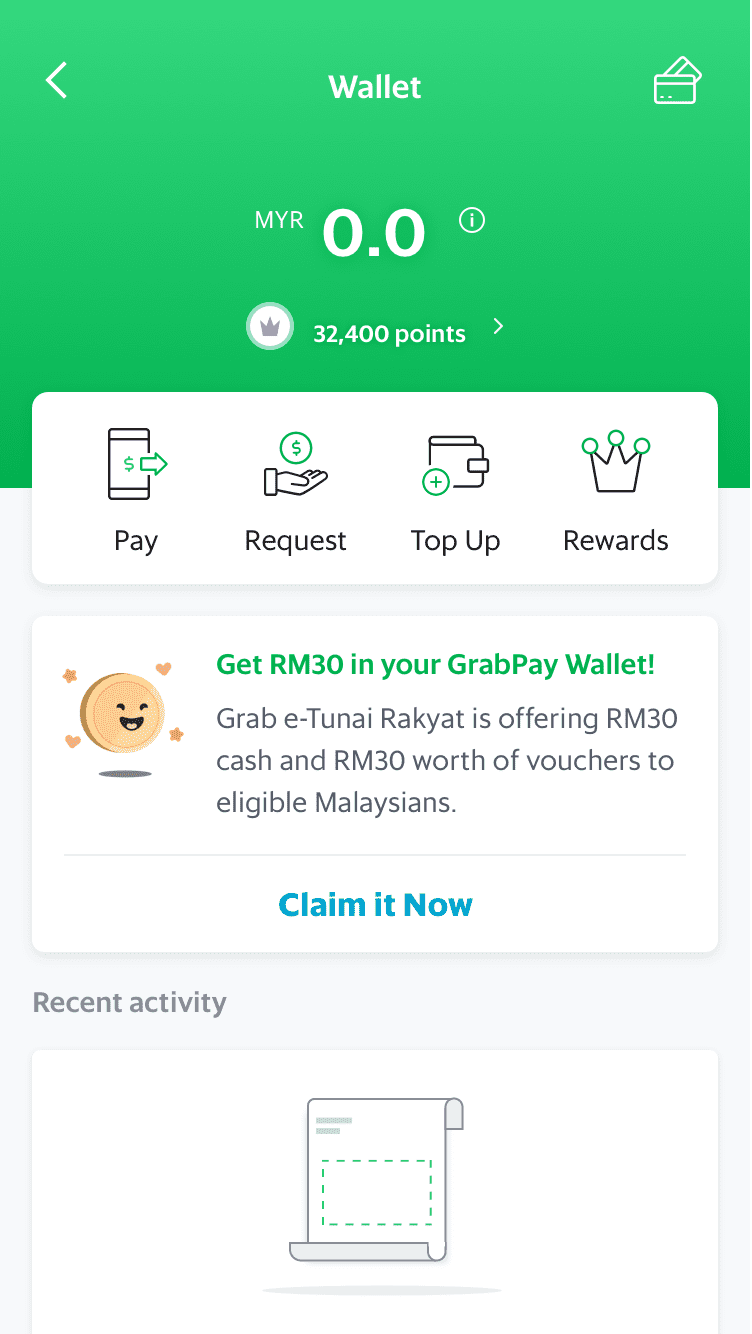

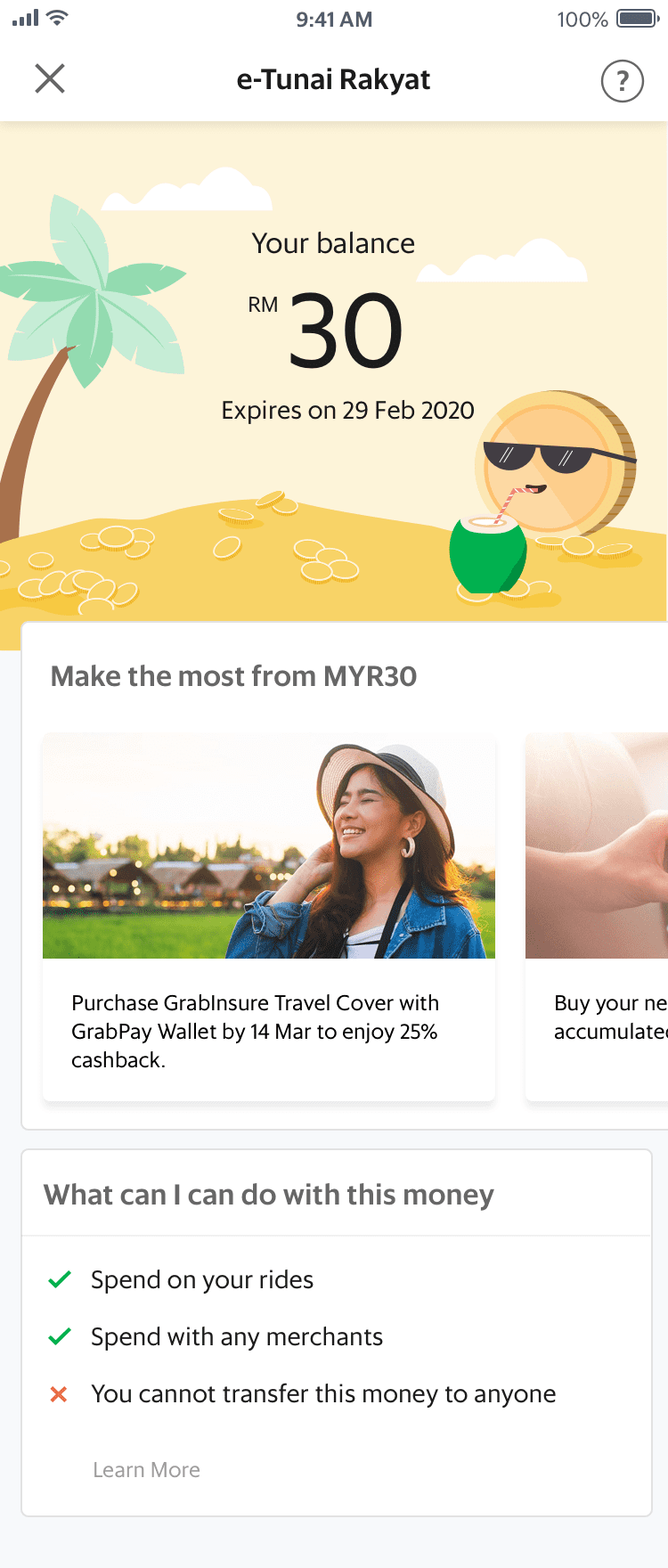

Open your GrabPay Wallet and Tap Claim It Now on the e-Tunai Rakyat option

-

Upon claiming the RM30 incentive, you will be able to view the 'Travel Cover' in the e-Tunai Rakyat page or the insurance 'icon' in your homepage

-

Go to 'Insurance' on your homepage and tap on view 'Travel Cover'

-

Get an instant quote by including your details (trip duration, destination and people travelling)

-

Confirm payment

Terms & Conditions

- From 15 January 2020 to 14 March 2020 (both days inclusive) (“Promotion Period”), 25% cashback via GrabPay Wallet credits (“Cashback”) will be awarded to the first 150,000 consumers who purchase a single-trip travel insurance policy covering domestic journeys within Malaysia and overseas journeys to certain Asia Pacific countries and territories (“Travel Cover”) – capped at a maximum of 8 insured persons and up to a period of insurance of 14 days per policy (“Promotion”).

- Travel Cover is underwritten by Chubb Insurance Malaysia Berhad (“Chubb”) (licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia) and distributed by GrabInsure Agency (M) Sdn Bhd, an affiliate of the Grab Group of companies.

- The Promotion applies to overseas journeys to Australia, Bangladesh, Brunei, Cambodia, China (excluding Tibet and Mongolia), Hong Kong SAR, India, Indonesia, Japan, Korea, Laos, Macau SAR, Maldives, Myanmar, New Zealand, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam. The Promotion also applies to domestic journeys within Malaysia and travelling more than 50KM from place of residence.

- In order to enjoy this Promotion, each consumer must fulfill the following criteria: (i) the consumer must be a first time purchaser of Travel Cover; (ii) the consumer must have successfully signed up for Grab e-Tunai Rakyat; and (iii) the consumer must be the first 150,000 consumers to successfully complete the purchase of Travel Cover during the Promotion Period.(“Eligible Consumer”)

- Each Eligible Consumer may only receive one (1) Cashback under the Promotion.

- The Cashback will be credited back to the Eligible Consumer’s GrabPay Wallet.

- The Eligible Consumer may cancel the Travel Cover at any time by giving written notice (“Cancellation Notice”) to Chubb. In the event the Certificate of Insurance has already been issued before Chubb’s receipt of the Cancellation Notice, no refund of premium shall be made.

- Chubb and/or Grab reserves the right to suspend or terminate the Promotion, or vary any terms and conditions herein, at any time without notice.

- This Promotion cannot be used in conjunction with other incentives and promotions offered by Chubb and/or Grab.

- This Promotion will not affect or vary any term of Travel Cover policy wording (“Policy Wording”). In the event of a conflict or inconsistency between these terms and conditions and the terms and conditions of the Policy Wording, the terms and conditions of the Policy Wording shall prevail. Please refer to the Policy Wording for the full details of all benefits, terms and exclusions that are applicable to Travel Cover.

- To the fullest extent permitted by law, Grab and Chubb shall not be liable for any claim, loss or damage whatsoever incurred directly or indirectly due to the Promotion or suitability of Travel Cover offered to the consumers by Chubb.

Use your Grab e-Tunai Rakyat for Travel Cover

This is for those who will be joining the cashless revolution! In Budget 2020, it was announced that the Ministry of Finance will provide RM30 credit to e-wallet users aged 18 and above earning less than RM100,000 annually as a one-off measure to stimulate the use of e-wallets in the country.

GrabPay is one of the official e-Wallet partners for the e-Tunai Rakyat initiative by the Ministry of Finance. The RM30 can be claimed from GrabPay, and used for a two-month period, from 15 January 2020 to 14 March 2020.

Upon activation of your GrabPay Wallet and successful verification, you will receive your RM30 credit which you can use for Travel Cover! Remember, you will enjoy 25% cashback when you purchase Travel Cover before 14 March 2020.

There’s more! You can claim up to RM3,000 value in credit and vouchers if you are the first few to claim from GrabPay!

Siapa cepat, banyak dapat!

Activate your GrabPay Wallet now!

FAQs

To purchase Travel Cover, please ensure you have sufficient balance in your GrabPay Wallet. If the purchase is still unsuccessful, please submit the Help Centre form so we can assist you.

If you wish to change or update any details in your policy, please contact Chubb at +603 2058 3181 (Mondays to Fridays, 8:30 AM – 5:15 PM, excluding public holidays). Please note that any changes made directly with Chubb will not be reflected in your policy on the Grab app.

Go to Grab app > Insurance > Travel Cover and click on the profile icon on the top right corner.

- A user of the Grab app, a Malaysian, Malaysian permanent resident, holder of a valid work permit (issued by the authorities in Malaysia), employment pass, dependent pass, long-term social visit pass, or student pass, who are at least 18 years of age, up to and including 75 years of age, his/her spouse and/or dependent children.

- If the traveller is below the age of 18, his/her parent or guardian can enter into this contract of insurance on behalf of the traveller.

- Travellers who are departing from and returning to Malaysia.

No. You must purchase your policy before you depart from Malaysia.

Yes. To cover any additional dates during your trip, you need to purchase another policy via the Grab app.

Yes. Your friend will need to purchase a separate policy through his/her own Grab app.

No. The policy does not offer coverage for any pregnancy-related condition that results from or is a complication of pregnancy, childbirth, miscarriage (except miscarriage due to accidental injury).

No. The policy does not cover any pre-existing medical conditions which the insured person was diagnosed, treated or knew about 12 months prior to the effective date of the Travel Cover.

No. You are not covered if you have direct participation in any acts of terrorism, or if you suffer any losses caused by terrorist attacks by nuclear, chemical and/or biological substances.

- Yes. Activities that are accessible to the general public without restriction (other than height or general health or fitness warnings) and which are provided by a recognised local tour operator are covered. Provided that you are acting under the guidance and supervision of qualified guides and/or instructors of the tour operators when carrying out such tourist activities.

- However, the policy does not cover any activities, sports or sporting activities that present a high level of inherent danger (i.e. involves a high level of expertise, exceptional physical exertion, highly specialised gear or stunts) including but not limited to big wave surfing, canoeing down rapids, cliff jumping, horse jumping, ultra-marathons, biathlons, triathlons, skydiving, and stunt riding.

- Yes. Cover commences at the time you leave your place of residence in Malaysia to go directly to your departure point.

- Coverage ceases when you arrive at your place of residence in Malaysia, or the date on which the policy is terminated, whichever is the earliest.

No. You do not have to pay any excess. You will be paid the full benefit amount up to the sum insured if you satisfy the terms and conditions of Travel Cover.

The Chubb Assistance team is ready to assist you. Please call the 24-hour hotline: +603 7628 3703 for immediate support.

Got a question?

Contact Chubb Customer Service at +603 2058 3181 (Mondays to Fridays, 9.00am – 5.00pm, excluding public holidays).

You can also call the Grab Customer Experience team at +1300805858.

Chubb is the world’s largest publicly traded property and casualty insurer. Chubb’s operation in Malaysia (Chubb Insurance Malaysia Berhad) provides a comprehensive range of general insurance solutions for individuals, families and businesses, both large and small through a multitude of distribution channels. With a strong underwriting culture, the company offers responsive service and market leadership built on financial strength. Chubb in Malaysia has a network of 23 branches and more than 2,600 Independent Distribution Partners (Agents).

More information can be found at www.chubb.com/my/

Travel Cover is underwritten by Chubb Insurance Malaysia Berhad, a general insurer licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia. Grab Car Sdn Bhd is the master policyholder under the Master Policy, distributed by GrabInsure Agency (M) Sdn. Bhd., a registered agent of Chubb Insurance Malaysia Berhad.

Forward Together

G-02 Ground Floor, Block A,

Axis Business Campus,

No 13A & 13B Jalan 225,

Section 51A, Petaling Jaya,

46100 Selangor.

Business Registration:

MyTeksi Sdn. Bhd. - 201101025619

GrabCar Sdn. Bhd. - 201401013360

About

Consumer

Quick Links

Enjoy 9% (RM8) Rebate at

AEON

- Valid from 15 Jan 2022 – 28 Feb 2022

- Minimum spend: RM88

- Limited to 62,500 redemptions

- TWO(2) redemptions per user throughout the campaign

1. Campaign period is from 15 January 2022 (12:00am) – 28 February 2022 (11.59pm).

2. GrabPay users are eligible for a “RM8 rebate” in your “My Rewards” when you spend a minimum of RM88 on a single receipt via GrabPay Wallet.

3. The offer of “RM8 rebate” is limited to a total of 62,500 redemptions throughout the campaign period.

4. Offer is valid for TWO (2) in-store redemptions with a cap of ONE(1) redemption per user per day throughout the campaign. Shared across AEON Co, AEON BiG, AEON MaxValu Prime, and AEON Wellness throughout the campaign period.

5. The “RM8 rebate” will be awarded instantly with a minimum transaction of RM88 with GrabPay at all outlets of AEON Co, AEON BiG, AEON MaxValu Prime, AEON Wellness; The rebate can be found under “My Rewards”. Rebate must be redeemed by clicking “use now” under “My Rewards” 30 days from the date of issuance.

6. The campaign will cease once all redemptions have been fully awarded or at the expiration of the campaign period, whichever is earlier.

7. Offer is based on a first come first served and while stocks last basis only.

8. Grab and AEON Group shall not be under any obligation to inform users, on any communication channels once the offer has been fully redeemed.

9. Offer is only available for AEON Co, AEON BiG, AEON MaxValu Prime, and AEON Wellness physical stores purchases at cashier counter only via GrabPay Wallet; offer is not applicable for online or GrabMart purchases.

10. Offer is not exchangeable for cash or replacements.

11. Offer is not valid with any other voucher, discount or promotion.

12. Grab and AEON Group reserve the right to alter, extend or terminate the promotion, or amend the terms and conditions at its sole discretion at any time without prior notice. In case of any disputes directly or indirectly arising from the promotion, the decision of Grab and AEON Group shall be final.

13. These terms and conditions shall be governed by the laws of Malaysia and any dispute arising out of or in connection with promotion shall be referred to the exclusive jurisdiction of courts of Malaysia.

14. This rebate is non-transferable to any party.